Stop selling creative disruption and start selling risk reduction

Marketers, particularly in B2B brands, need to show CFOs that brand building is about limiting the business’s downside as much as generating upside.

Marketers love talking about disruption. But often the only thing marketers disrupt is sales.

Just ask Aberdeen, the financial services firm that thought eliminating all vowels from its name (becoming ABRDN) would somehow modernise the brand. After years of ridicule and persistent client outflows, Aberdeen re-rebranded faster than you can say “iatrogenic” – the medical term for a cure that makes a sickness worse.

Aberdeen’s act of brandalism is not an isolated incident. You can pin it on a crowded Wall of Shame, alongside Tropicana’s packaging disaster, Weight Watchers’ catastrophic shift to WW and Jaguar’s recent debacle. In B2B, countless SaaS companies have dropped descriptive names in favour of meaningless invented words, only to watch their pipeline dry up when prospects can’t remember what they do.

Each incident represents millions or billions in lost sales and wasted spend. Marketers – especially freshly minted CMOs – seem to love playing rebrand roulette with a loaded gun.

Rebrands are a particularly extreme example of a broader phenomenon: marketing’s biggest blind spot isn’t lack of creativity, it’s failing to see itself as risk management. Marketers think like venture capitalists: the more risk, the more upside and the key is to take as much risk as possible. But by some estimates, 80% of VC firms underperform the S&P 500.

Instead of thinking like venture capitalists, marketers need to start thinking like CFOs. CFOs spend their time dwelling on downside, not just chasing the upside. And now, with AI-driven tools like synthetic research, CMOs can finally speak the CFO’s language by proving that marketing doesn’t just drive growth – it also helps cap downside.

The great risk divide

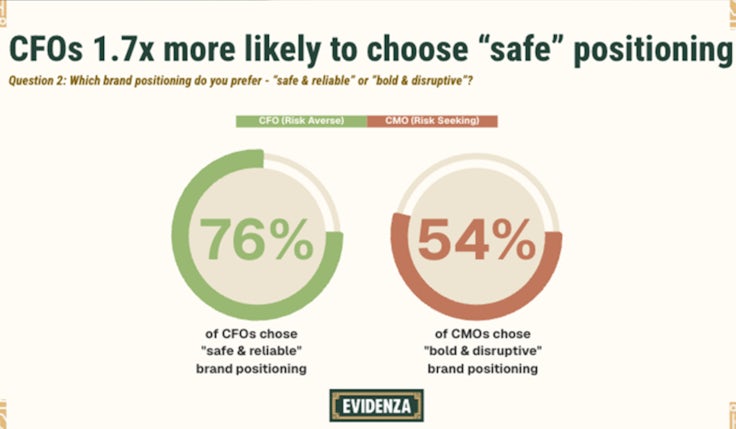

Evidenza.ai, the company we founded, recently ran a synthetic survey to 500 AI-generated CMOs and 500 AI-generated CFOs. When we asked about attitudes towards risk, the results were startling. When asked whether brands should pursue ‘safe and reliable’ versus ‘bold and disruptive’ positioning, 76% of CFOs chose safe and reliable. Meanwhile, 54% of CMOs opted for bold and disruptive. Safe and reliable doesn’t win you a Cannes Lions, after all.

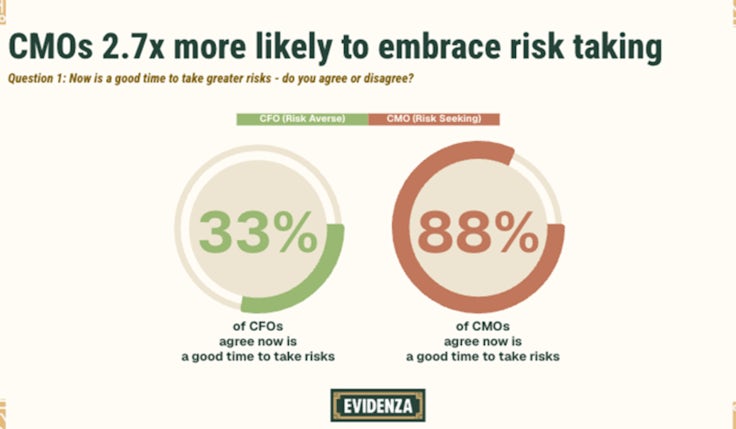

The gulf widens from there. When asked if now is a good time to take greater risks, only 33% of CFOs agreed, while a whopping 88% of CMOs said yes.

Most tellingly, when asked where ‘identifying and mitigating business risk’ ranks among their responsibilities, CFOs placed it at number one. CMOs? Number six. Risk is not even on the CMO radar.

CFOs live in a downside-first world, CMOs live in an upside-first world. CFOs are from Wharton, CMOs are from Hogwarts. The problem for marketers is that the CFO secretly runs the marketing department. They control budgets and compensation. They’re the CEO’s right hand. The CFO doesn’t answer to the CMO – it’s the other way around.

Marketing as risk insurance

Now to be clear, we’re not suggesting that marketers should take no risks. Playing it safe can be downright dangerous, especially when it comes to creative, where boring executions fail to gain customers’ attention or brand attribution, the preconditions for driving any sales.

What we are suggesting is that marketers desperately need to rethink their internal communication strategy. In other words, the marketing of marketing. CMOs need to stress that marketing doesn’t just drive upside, it caps downside.

There are four non-obvious but very real ways that marketing de-risks your business – and CFOs need to understand them all:

1. Category optionality: Strong brands provide the ability to escape dying categories and move into thriving ones. Nokia pivoted from timber to mobile phones. Nintendo went from playing cards to video games. In B2B, IBM transformed from tabulating machines to IT services to AI, while Salesforce expanded from CRM to become an entire enterprise platform. Radio Shack, pinned to a dying category by its very name, couldn’t make that leap. Categories are mortal, brands can live forever – assuming they survive the new CMO administration.

2. Cheaper capital: Strong brands borrow money more cheaply. Netflix and Microsoft can issue debt at favourable rates precisely because of their brand strength. This cheaper capital becomes a competitive advantage that compounds over time. The CFO negotiating those rates succeeds or fails based partly on the CMO’s brand building. We’ve seen empirical research on this topic, but we’ve never seen a marketer make this case, ever.

3. Customer concentration risk: Wall Street punishes companies that depend on a handful of whale clients – and in B2B enterprise software, this is endemic. Brand building broadens your customer base, spreading risk across segments. It’s the difference between having three enterprise clients who could kill your company by churning versus having thousands of mid-market accounts. Broad reach isn’t just about growth – it’s about de-risking your revenue streams and diversifying your customer portfolio.

4. Economic resilience: During turbulence, brands with pricing power can raise prices above inflation. Look at Hermès weathering every recession by charging more for handbags. And decades of research shows that brands maintaining investment during downturns capture share from competitors who pull back. You don’t even need to increase spending – just holding the line while others retreat wins you market share.

AI: The proof point CMOs need

In theory, marketers already have a tool to help them mitigate risk: market research. Test before you invest. Survey before you rebrand. Focus group before you launch. Market research should prevent Aberdeen-style disasters.

In practice? Market research itself has become so risky that most companies simply don’t attempt it. Traditional research carries three types of risk that paralyse marketers: professional risk (spend £500,000 on a useless survey and you’re fired), legal risk (especially in regulated industries requiring months of compliance reviews), and reputational risk (testing sensitive pricing or product strategies with real customers who might leak the information).

The tool that should reduce risk has become a risk itself. It’s like having a smoke detector that might burn down your house.

CFOs live in a downside-first world, CMOs live in an upside-first world. CFOs are from Wharton, CMOs are from Hogwarts.

Enter synthetic research, where marketers survey AI-generated copies of customers instead of real ones. AI isn’t just making market research faster or cheaper – it’s finally making it safe enough to actually use.

When research is a fraction of the cost and takes days instead of months, the professional risk evaporates. When you’re surveying AI-generated respondents instead of real people, legal compliance becomes dramatically simpler – our pharma clients are thrilled they don’t need to agonise over HIPAA violations or ask respondents to sign disclosure forms. And when you’re testing rebrand concepts with synthetic CEOs, there’s zero risk of your hundred-year-old brand’s new identity leaking before launch.

Obviously, marketers still need to think about compliance and data security when using AI tools. But managing the risks of an AI platform is far easier than preventing screenshots from an online focus group going viral or ensuring hundreds of human respondents honour their NDAs. The risk surface area shrinks from hundreds of unpredictable humans to one manageable technology vendor.

What’s happening in synthetic research is just the beginning. The same risk reduction will cascade through every marketing function. Ad creative development becomes less risky when you can generate hundreds of variations quickly and cheaply, then test them rigorously on synthetic audiences before blowing through your media budget. Product development transforms when you can simulate market response before the assembly lines start rolling.

AI isn’t just making marketing faster or cheaper – it’s giving CMOs the proof they need to show CFOs that marketing is risk management, not risk creation.

Fighting finance with finance

In an era when CFOs control the purse strings, the future of marketing belongs to leaders who stop selling ‘creative disruption’ and start selling ‘risk reduction’.

Frame brand building as portfolio diversification. Position market research as risk identification, not insight generation. In B2B particularly, talk about brand advertising as shortening sales cycles and reducing customer acquisition costs.

Think about the most famous tagline in B2B history: nobody ever got fired for buying IBM. That reduction of personal and professional risk is what a brand provides. Especially in B2B, where buyers are risking their careers on vendor selections that could tank their digital transformation, a strong brand provides psychological insurance.

Your brand literally protects your customer’s job.

Why don’t we try letting it protect our jobs, too?

Peter Weinberg and Jon Lombardo are co-founders of AI-powered synthetic research company Evidenza.