Airbnb shifts ad focus ‘from TV to social’ as marketing investment grows 19%

Performance marketing is the “surgical topper” to Airbnb’s brand marketing, says CFO Ellie Mertz as the business posts strong Q2 results.

Airbnb increased its sales and marketing spend by 18.7% in the three months to the end of June, as the business rethinks its marketing mix after repositioning as a full-service travel brand offering more than just overnight stays.

“We’re shifting a lot of our advertising from TV to social,” said CEO Brian Chesky on a call with investors yesterday (6 August).

He noted that customers are using Google for inspiration rather than “high-intent” purchase decisions, with social media taking the number one spot. “The whole world [is] seeing that a lot of travel is switching from desktop to mobile and from Google search to social media,” he explained.

With these changes to customer behaviour, Chesky believes Airbnb is “really primed for social media”.

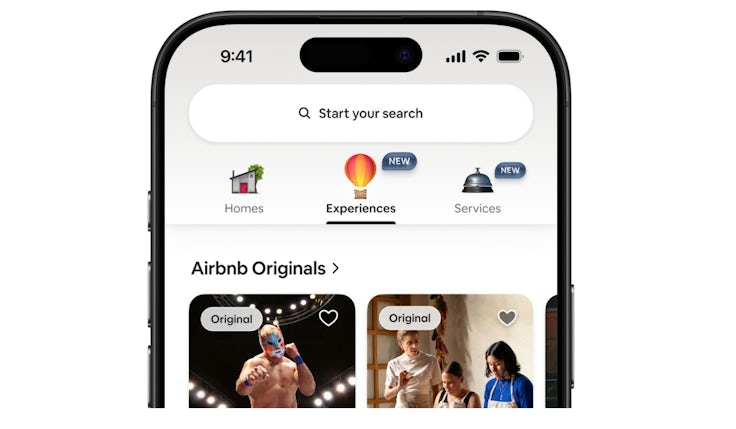

Airbnb promises ‘best of both’ with new look services and experiences

“I think that you’re going to see a lot more of social media native advertising. So, we’re shifting a lot of our advertising from TV to social,” he said.

He praised social’s targeting abilities for the brand. “We know a lot more about the customers. We know if they’re Airbnb customers. When they watch an ad, we can link it to inventory and get them to go directly to the app. So it’s actually, we think, very, very performative. So this is what we’re going to be doing with marketing.”

“We continue to use performance marketing as a, I would say, surgical topper to the majority of our spend being in brand,” chief financial officer Ellie Mertz explained.

She reiterated that the split between brand and performance marketing remains weighted to brand. “Our strategy in terms of the marketing channel mix is obviously quite a bit different from others in that we’re able to benefit from… the strength of our brand and the singularity of our brand to put money in a larger allocation of our marketing spend behind brand versus performance.”

Airbnb’s move from a performance-led marketing strategy to brand-building post-pandemic was significant, with then-CFO Dave Stephenson saying it was the “right shift” in 2022.

90% of Airbnb’s traffic comes from “direct and unpaid sources”, she added, which gives the brand an advantage over competitors and can “spend a lot less on performance marketing than others.”

Airbnb invested an additional $200m (£149m) behind its services and experiences proposition, which focused on field operations, go-to-market activities and supply acquisition, said Mertz.

The business is “not spending more to effectively advertise multiple brands”, she said. “Instead, we are spending behind a single brand.”

‘Market the entire offering’

In terms of the focus of its marketing campaigns, Chesky said: “We think that probably going forward, the best way to market services and experiences is to actually market the entire offering of Airbnb.”

Airbnb appointed Rebecca Van Dyck as its chief marketing officer in June, at the same time Hiroki Asai left his global head of marketing role for the newly created chief experience officer job amid a “major transformation”.

The shift in marketing mix builds on comments made to Marketing Week by Asai in May, when he explained it was going to “reintroduce” the brand through a social-first strategy.

‘Tell don’t sell’: Why Airbnb is leveraging ‘social search’ as it expands into new categories

When asked if the brand is increasing the intensity of its marketing to achieve its new ambitions, Chesky added: “We don’t think that the marketing intensity per se has to increase, because we think we get a lot more for our dollar by marketing all of our offerings.”

It was a strong quarter for Airbnb. Its revenue grew 13% year-on-year to $3.1bn (£2.3bn), driven by “solid” growth in the number of overnight stays and the timing of Easter.

Its adjusted EBITDA grew by 17% to $1bn (£746m), making the business’s adjusted EBITDA margin 34%.

“We had a strong Q2, exceeding expectations across our key metrics, which reflects the progress we’ve made against our priorities, including unveiling Airbnb’s next chapter,” added Chesky. “We’re excited by the early momentum behind the launch of Airbnb services and reimagined Airbnb experiences and believe both will be key contributors to long-term growth.”